Innovative Approaches to IPOs and SPACs in Today's Market

Written on

Chapter 1: The Changing Landscape of IPOs

Navigating the corporate world can be challenging, especially with significant interviews on the horizon. My objective for the upcoming week is to engage with Product Managers at Microsoft and rehearse mock interviews with them. Cold emailing professionals on LinkedIn has proven beneficial; they are often willing to assist!

This paragraph will result in an indented block of text, typically used for quoting other text.

Section 1.1: The Rise of SPACs

Currently, Special Purpose Acquisition Companies (SPACs) are gaining immense popularity. For instance, Flipkart, a leading e-commerce platform in India, is in discussions with various SPACs to secure a listing in the U.S. market, potentially aiming for a valuation of around $35 billion.

A brief overview of SPACs from ET Tech provides clarity: "SPACs, also known as 'blank check' companies, are entities formed solely for the purpose of merging with a private enterprise. These companies are listed on stock exchanges without any operational business, raising capital from investors. They typically acquire private firms, facilitating a swift public offering without the complications associated with a traditional IPO. A SPAC has a two-year window to locate a target company, or else it must refund the investors."

Overall, private companies can find it significantly more straightforward and quicker to raise funds through a SPAC. If this trend continues, stock exchanges might need to reconsider how they streamline the IPO process, reallocating resources to adapt to our fast-paced environment.

Subsection 1.1.1: Innovative Carbon Solutions

An exciting business concept involves utilizing carbon sequestration technologies to help combat global warming, aiming to stay below the internationally agreed limit of 2°C (3.6°F). For insights, the EN-ROADS simulation model created by Climate Interactive and the MIT Sloan Sustainability Initiative is worth exploring.

What if we could engineer advanced carbon sinks and position them near industrial zones? Companies could potentially negate carbon taxes by utilizing these sinks for carbon offsetting. I would love to hear your thoughts on this idea—please respond to this email with any feedback!

Section 1.2: Leveraging Intelligent Marketing

In today's digital landscape, intelligent marketing strategies yield impressive outcomes. Everyone has experienced this phenomenon; searching for something on Google often leads to interacting with similar advertisements.

Top Tool: Milk Video

Not everyone has the time to engage with lengthy podcasts or discussions. Milk Video simplifies the process of sharing impactful clips from such content, allowing users to highlight key moments effortlessly.

Top Read: The Lean Startup by Eric Ries

I've been frequently using the term "validate assumptions," a concept I embraced from this insightful book.

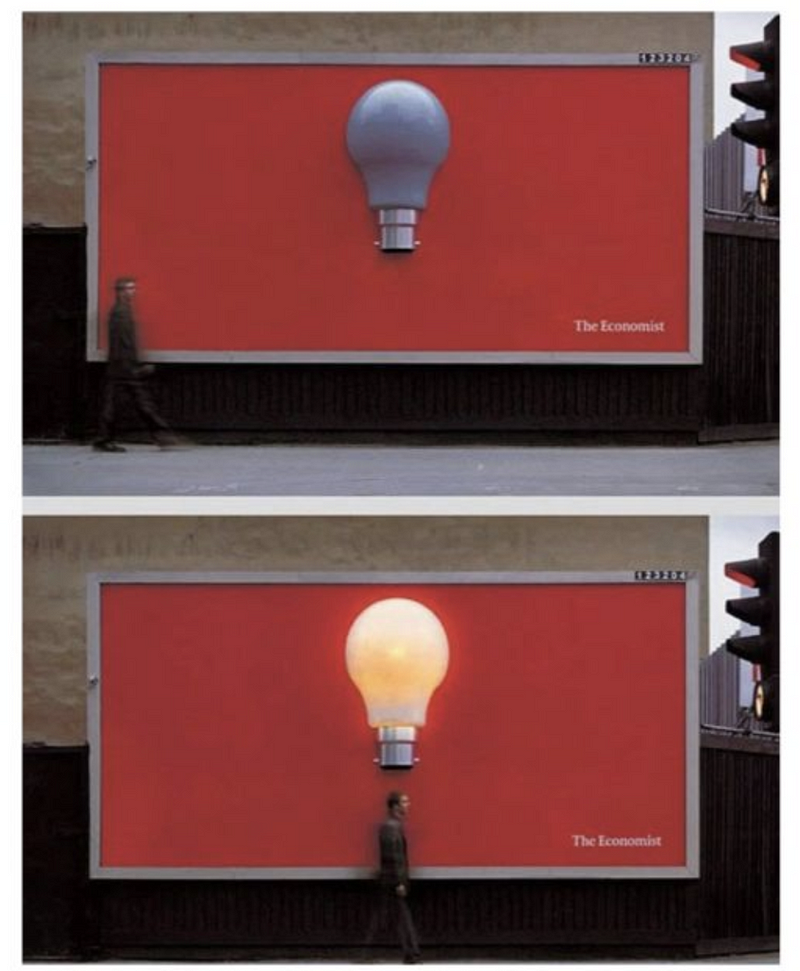

Top Tweet: Creative Marketing Example

“Genius billboard from The Economist. A lightbulb illuminates when you walk underneath.” — Trung Phan

Chapter 2: Valuable Insights from the Market

In the first video, "Ep 155: Before Trading or Investing in an IPO: What YOU Should KNOW!" essential tips for navigating IPO investments are discussed, providing critical insights for potential investors.

The second video, "How to Value Any Company and When to Buy | Stock Market for Beginners," offers foundational knowledge for beginners interested in stock market investments and company valuation techniques.

Please leave your comments here! Gain Access to Expert View — Subscribe to DDI Intel