Navigating Startup Challenges: The Importance of Being Investable

Written on

Chapter 1: The Shift in Startup Dynamics

In the bustling environment of New York City, particularly from the vantage point of a $100 billion fund's high-rise office, the atmosphere exuded confidence even amidst the ongoing market downturn. During a summer visit, I had the chance to reconnect with a fellow investor who was actively involved with several of our portfolio companies. I was eager to learn how they were approaching follow-on investments, both proactively and defensively. Their response was clear: “We’re open for business, but with distinct boundaries—think of us as an ICU, not a hospice.”

This succinct analogy conveys that while they are willing to support startups that are fundamentally sound and require urgent care, they are not in the business of prolonging the life of companies that lack a viable future. This perspective seemed entirely reasonable.

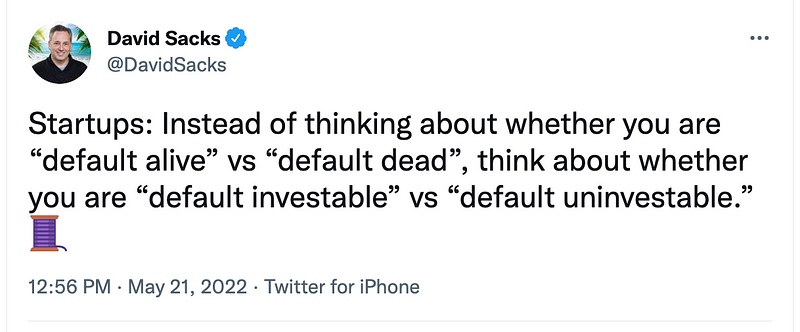

As the months progressed, I found myself reflecting on this conversation while advising the CEOs within our portfolio. The core sentiment from that ICU discussion remains as relevant today as ever. David Sacks’ insight, shared in a tweet, encapsulates a vital truth about navigating downturns.

Section 1.1: Understanding "Universal Truths"

When I refer to a “universal truth,” it’s essential to note that it doesn’t apply to every business model. Numerous quality small to medium-sized enterprises (SMEs) and startups operate outside the realm of venture capital. Additionally, some venture-backed companies may find that the best course is to wind down, rehome, or restructure rather than chase further investment. However, for those who aspire to fulfill their founding vision and seek future venture funding, the focus on growth must persist.

Subsection 1.1.1: Balancing Growth and Costs

It’s possible to manage costs while still pursuing growth. Adjusting the growth trajectory during a phase of retrenchment is feasible; experimenting with new customer bases or reevaluating product-market fit (PMF) can yield valuable insights. Nevertheless, the objective is to emerge from this phase with a startup that remains attractive to investors. Simply extending the runway by reducing expenditures or lengthening timeframes until cash depletion is insufficient if it doesn’t contribute to a sustainable growth strategy.

Transitioning to a mindset focused solely on survival can jeopardize future fundraising opportunities.

Section 1.2: The Concept of "Default Investable"

Understanding the difference between being “default alive” and “default investable” is crucial. While knowing how long you can sustain operations is important, being “default investable” implies that you have a clear strategy for securing additional capital. As a CEO, this understanding should be your starting point.

Chapter 2: Strategies for Success

In the video "Save Your Startup During an Economic Downturn," industry experts share strategies to help startups navigate tough financial climates.

The video titled "Why the Tech Downturn Could Be a Boon for Startups" discusses how challenging times can present unexpected opportunities for growth and innovation.