The Growing Series A Gap: Challenges and Opportunities Ahead

Written on

As we approach the one-year mark since the pandemic began, many discussions have emerged regarding the changes in our lives. Yet, it's equally important to recognize that several trends have remained constant or even intensified since March 2020. One such trend is the increasing disparity in Series A funding. Here’s our perspective on this development.

# 1. An influx of new VC funds is saturating the Seed stage

In a previous article, I discussed the disruption occurring in traditional late-stage venture capital. Since 2009, there has been a twenty-fold increase in Seed stage venture funds. This surge in new general partners (GPs) and the capital they are injecting into the market is starting to yield noticeable effects.

The rise in Seed stage valuations, particularly in renowned tech hubs like Silicon Valley, is a direct outcome of this increase in funding. The pandemic prompted a notable migration of tech professionals and investors from major cities such as San Francisco and New York, leading to a significant drop in rents—up to 33% in San Francisco. Additionally, labor rates for tech talent saw a decline due to widespread layoffs, which freed up talent across the sector.

Contrary to predictions of a collapse in Seed stage valuations, these valuations actually soared throughout 2020 in all major tech centers. While several factors contributed to this, a critical one has been the unprecedented amount of capital flowing into the Seed stage.

Innovation in VC is overdue but carries risks

We are optimistic about the emergence of new players in the venture capital landscape and welcome the recent innovations within the asset class, including structural and organizational advancements such as "nano funds," rolling funds, and AngelList syndicates, as well as product innovations like venture debt and revenue-based financing from companies like Pipe and ClearBanc.

Historically, venture capital has operated in a somewhat opaque manner, which benefited a select few established firms while limiting access to capital and mentorship for less connected entrepreneurs. However, the rise of technologies that enable remote collaboration is helping to break down these barriers.

With more GPs working in the Seed stage, a larger number of startups can secure the necessary funding to bring their offerings to market and embark on their growth trajectories. Additionally, innovative funding solutions provide founders with less dilutive options compared to traditional venture financing.

Nevertheless, this influx of capital into the Seed stage creates a paradox: while more startups secure funding, they also face increased competition for subsequent financing rounds—typically the critical Series A. Alarmingly, the number of funds dedicated to Series A investments has been declining over time.

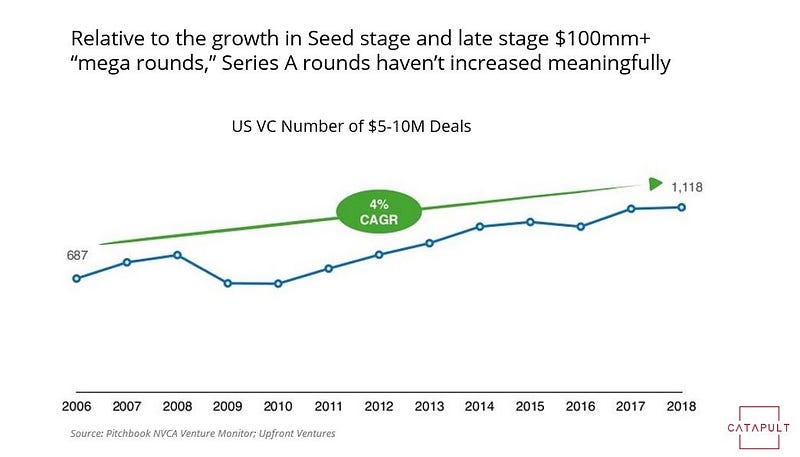

The growth of Seed stage financing and late-stage "mega rounds" exceeding $100 million has been significant, yet traditional Series A and B venture capital has remained relatively stagnant. As a result, we are now facing a "barbell problem" and a Series A crunch.

Seed funds excel in syndication but struggle to lead Series A rounds

Currently, most Seed financings in the U.S. are structured as Convertible Notes or SAFE Notes. The latter, introduced by Y Combinator, has transformed Seed stage financing. In these deals, the concept of a "lead investor" is somewhat misleading, as all investors typically participate under the same terms. While one investor might negotiate terms, all Seed investors generally share in the investment equally.

Many participants, few leaders

Once a startup successfully completes its Seed round, it often must prepare for its next financing round, usually the Series A. In today's landscape, there are often several interim rounds—like Seed 2 or Seed Extension—before reaching Series A. These interim rounds, once seen negatively, have lost that stigma in a capital-rich environment, where funds specializing in these stages, such as Bullpen Capital, have emerged.

Regardless of when a startup decides to pursue a Series A, many face significant challenges. Although Seed stage capital is relatively abundant, Series A funding is scarce and highly competitive. This is exacerbated by (1) the limited number of venture funds focusing on leading Series A rounds and (2) the growing number of Seed-funded startups vying for those critical Series A dollars.

# 2. Series A funds are raising the bar for startup traction

It's often humorously stated that Series A has become the new Series B. With abundant Seed stage capital and fewer Series A investors, the expectations for startups aiming for Series A funding have risen significantly compared to just a few years ago.

Startups are now raising larger amounts of capital before seeking Series A, leading investors to demand more in terms of traction and performance metrics. Given the reduction in startup launch costs due to cloud-based solutions, Series A investors are increasingly focused on tangible evidence of traction and sustainability.

# 3. Traditional early-stage VC firms are growing and moving later

The long-running tech bull market has led to an increase in assets under management (AUM) for many established venture funds that once concentrated on early-stage investments. While a few notable firms have maintained consistent fund sizes, many well-known funds have significantly increased their AUM over the past decade—some by four times or more.

This shift means that a fund managing $200 million a decade ago may now be working with an $800 million fund. While these firms may claim to remain early-stage investors, the pressure to deploy larger capital amounts often leads to a focus on bigger, later-stage deals.

# The Road Ahead

We've witnessed similar situations before. In past market disruptions, funds recognized the opportunity, raised capital, and filled the Series A void. However, the current dynamics are different. We are seeing an 'atomization' within the venture capital asset class. Entrepreneurs are more informed about fundraising than ever and are prioritizing the selection of the right investors over brand recognition. While established VC brands still hold some weight, this influence diminishes as startups progress toward later stages.

We anticipate that more solo GPs and rolling fund investors will operate independently of larger firms. Additionally, we expect Seed stage firms that achieve meaningful exits to raise significantly larger follow-on funds, with many beginning to lead Series A rounds. Late-stage funds may adopt "full stack" strategies and create vehicles targeting Series A and Seed funding to maintain access to competitive early-stage companies.

However, for now, we face a distinct dislocation in the marketplace, characterized by an abundance of Seed and later-stage capital, while securing funding between these stages remains fiercely competitive. As one entrepreneur recently noted, "It's never been easier to be a Seed-backed entrepreneur, but it's also never been more challenging to raise a Series A."

Jonathan Tower is the Founder and Managing Partner at Catapult, a global early-stage venture firm based in Palo Alto. Catapult invests in promising startups from emerging tech ecosystems outside Silicon Valley, helping them scale globally. Jonathan's previous investments include Dollar Shave Club, Jet.com, Freshly, and others that have achieved significant exits.

Jonathan frequently writes on venture capital and technology topics on his blog, Adventure Capitalist, and has contributed to leading publications like The New York Times, Fortune, The Wall Street Journal, and more.

Follow Jonathan on Twitter @jonathan_tower