Elon Musk's Bold Move: From Mansion to Tiny House Living

Written on

Chapter 1: The Shift to Minimalism

Elon Musk, the world's wealthiest individual, has made headlines by opting to reside in a prefabricated house valued at just $50,000—a structure that can be assembled in under 24 hours. This unconventional choice raises questions about his motives. Is he making a foolish decision, or is there a calculated strategy behind this?

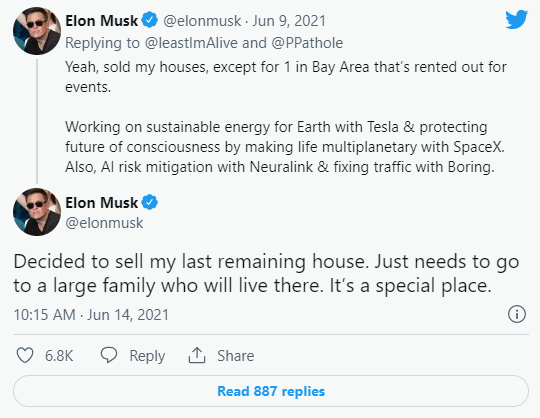

A recent tweet confirmed that Musk has sold all of his properties, including a Bay Area home listed for $37.5 million, which he purchased in 2017 for approximately $23 million. Was this sale simply a financial maneuver, or part of a more extensive public relations strategy?

In California, where Musk owned the majority of his homes, high living costs and steep taxes come to mind. Wealthy individuals often find ways to minimize their tax liabilities, employing strategies such as establishing corporations or taking minimal salaries. In contrast, the middle class and lower-income earners typically bear a heavier tax burden.

A finance expert once remarked, “Understanding how to legally avoid taxes is more crucial than your income level.” Indeed, in today's economic landscape, almost every aspect of life is subject to taxation.

According to Business Insider, between 2014 and 2018, Musk paid $445 million in taxes on $1.52 billion in taxable income, resulting in a tax rate of just 3.27%. Meanwhile, many in the lower and middle classes face tax rates exceeding 10% of their income.

Musk’s approach to managing his finances is complex. He has been focused on pursuing ambitious projects, which requires him to allocate resources wisely. By selling off his properties, he stands to decrease his tax burden and reallocate those funds towards his ventures.

Chapter 2: The Move to Texas

Musk currently resides in a tiny house located at the SpaceX Starbase facility in Texas, claiming to rent the space. This shift not only redefines his primary residence but also allows him to take advantage of Texas’s lack of state income tax.

It’s speculated that Musk’s decision to sell his homes was influenced by the impending financial changes he might face, including a potential multi-billion dollar bonus. Remaining a California resident would mean facing hefty taxes on any incoming earnings, prompting a move to a more tax-friendly state.

The pandemic prompted many to rethink their property investments, and Musk was no exception. Selling his homes before their values could drop provided him with necessary liquidity without sacrificing his investments. The takeaway here is that savvy individuals often have limited cash on hand, focusing instead on strategic investments.

Musk has always been someone who values ownership and responsibility. His numerous properties became distractions, taking time and mental energy away from his primary goals. He recognized that to fulfill his ambitions, he needed to eliminate these distractions—even if it meant parting with luxurious assets.

Living simply allows Musk to concentrate on his aspirations, a lesson applicable to all of us. We should strive to minimize distractions and prioritize our life's purpose, even if it requires significant sacrifices.

In his discussions, Musk has faced criticism for his wealth, particularly regarding his former extravagant properties. By downsizing, he aims to demonstrate that billionaires can lead modest lives without the need for opulence.

Ultimately, Musk's unconventional lifestyle choice serves as a reminder that breaking away from societal norms can lead to success. Embracing a less traditional path can set one apart in a world filled with conventional expectations.