The Unraveling of FAANG: What Lies Ahead for Tech Stocks?

Written on

The Current State of Nasdaq and FAANG

In the aftermath of the Great Financial Crisis, the stock market has experienced a significant bull run, particularly in technology stocks. Investors have flocked to these tech giants, viewing them as the primary growth sector.

Two key factors explain why technology has consistently outperformed other industries:

- Abundant liquidity in the markets.

- Continuous investments in tech enterprises and startups.

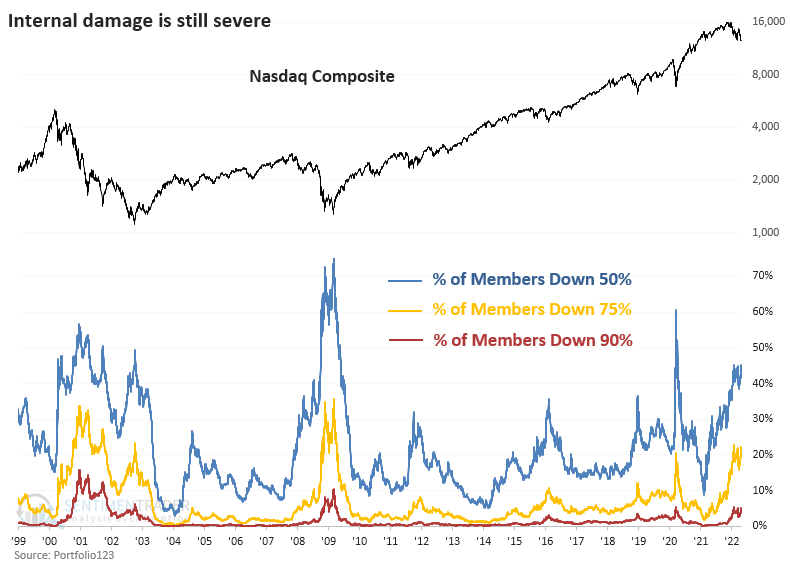

The allure of FAANG stocks (Facebook, Amazon, Apple, Netflix, Google) has become increasingly evident. They have effectively concealed the bear market affecting smaller stocks and individual companies. But how severe is the fallout?

If you’ve noticed your investment portfolio declining since January 2021, the breadth of the market is to blame. The strength that growth stocks once had has diminished, and institutional investors, often referred to as "smart money," have been offloading their shares. Meanwhile, the performance of FAANG has masked this distressing trend, leading many to maintain a false sense of security.

Why is This Significant Now?

The narrative surrounding FAANG stocks is beginning to shift as their core businesses show signs of stagnation and minimal growth:

- Facebook has struggled with its daily user growth, witnessing a drop of 47% from its peak, equating to a $613 billion loss in market capitalization.

- Netflix experienced its first decline in subscribers in over a decade, dropping 74% from its all-time high, resulting in a $243 billion market cap loss.

- Amazon's revenue growth has slowed to around 7%, a stark contrast to its historical 20% growth rate, with a significant $857 billion market cap loss since its peak.

A notable fact: we have seen two of the largest single-day market value losses in history, with Meta dropping $251 billion and Amazon losing $206 billion in a single day.

While it is common for growth stocks to correct by 35-40% even in a healthy market, FAANG stocks are no longer typical growth stocks. They have been the cornerstones of the bull market, and any dip in their performance can lead to substantial losses across portfolios.

Unexpected short-term fluctuations in these so-called "super mega" companies have taken the market by surprise. The foundations they rest upon are weakening, and the Federal Reserve's plans to cut interest rates may exacerbate the situation in an already precarious market environment marked by inflation.

Is It Time to Explore Beyond Technology?

Time will reveal the answers...

The first video, "FAANG Stocks CRASH ... When Do YOU BUY?" discusses the recent downturn in FAANG stocks and what it means for investors.

The second video, "Nasdaq and Dow Ratio Highlight FAANG Collapse, Fed and Recession Top Themes Next Week," highlights the broader implications of the FAANG stock performance amidst economic uncertainty.