Inflation Trends: Analyzing 2021's Impact and Future Outlook

Written on

Chapter 1: Understanding Inflation's Effects in 2021

As we close the chapter on 2021, the challenge of high inflation remains. Recently, the Bureau of Labor Statistics (BLS) released the Consumer Price Index (CPI) figures for December 2021, providing a comprehensive overview of inflation for the year.

Inflation experienced a significant rise of 7% in 2021, marking the highest annual increase since the 1980s. Before we delve into projections for 2022, it’s essential to identify which sectors of the economy faced the brunt of inflation.

Inflation by Sector

If you were unaware, the used car market faced severe challenges in 2021. Initially, during the pandemic, dealerships struggled to sell vehicles, but by 2021, the situation reversed, resulting in a drastic shortage of available cars. Consequently, prices for used vehicles soared. (I regret selling my 2005 Honda Civic in 2020—if only I had held on for a few more months.)

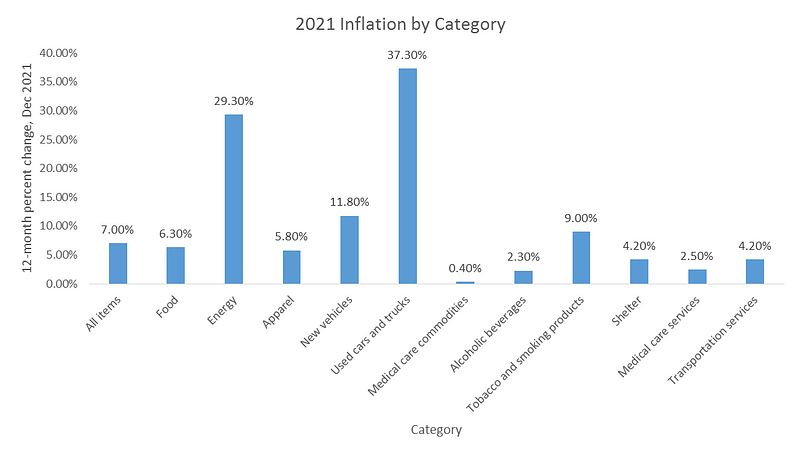

Another contributor to the rising car prices was the global semiconductor chip shortage, which affected various industries. Below is a visual representation of the data.

The significant figure to note is the “All items” category, which increased by 7%. This figure is concerning, as it far exceeds the Federal Reserve's target inflation rate of approximately 2%.

Food and energy are critical categories in this context. Economists utilize a metric known as Core CPI, which excludes food and energy prices. While I understand the rationale behind this measure, it’s crucial for me to track these essential costs, as they directly affect my disposable income.

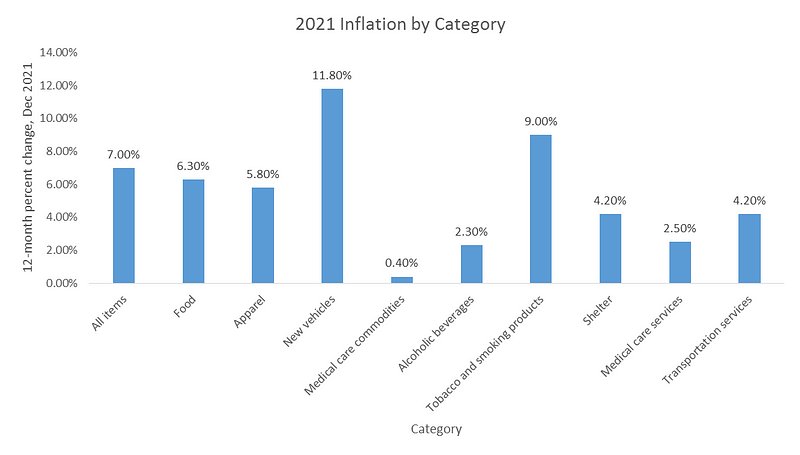

Excluding energy and used vehicles provides a clearer picture of inflation trends.

As illustrated, new vehicles currently reflect the highest inflation rates. Fortunately, the prices of alcoholic beverages have remained relatively stable—my favorite drinks will still be available at gatherings. Surprisingly, the costs associated with medical care commodities saw only minor increases, which may not hold true in future years.

Why Was Inflation So Elevated?

Supply chain disruptions have been widely cited as a primary cause of inflation. While this holds some truth, government actions from both past and present administrations have also contributed significantly.

The Federal Reserve has faced the most scrutiny, as their intervention at the pandemic's onset led to prolonged easy money policies. This has resulted in inflation reaching levels not seen in 40 years. With the Fed printing substantial amounts of money over the past two years, the increased money supply has diluted the value of the dollar.

Currently, the Fed is working to tighten its monetary policies, which has already affected technology and cryptocurrency markets. The notion of inflation being “transitory” seems increasingly unlikely.

Despite these challenges, I remain optimistic. The appreciation of asset prices over the past two years, fueled by the Fed's policies, has been remarkable. If someone had predicted the significant rise in stock, real estate, and cryptocurrency values during a pandemic back in 2019, I would have found it hard to believe.

What Lies Ahead for 2022?

Expect continued inflation, albeit at a lower rate than in 2021. The Federal Reserve will need time to shift from its current relaxed monetary policies to stricter measures. However, indications from their recent meetings suggest a readiness to expedite this transition. The next meeting on January 25–26 will shed more light on future expectations.

Supply and staffing shortages will persist as long as the pandemic continues to affect society. Addressing these issues will be crucial for balancing supply and demand.

While inflation is likely to exceed the 2% target, I anticipate it will not reach the 7% peak observed last year. The baseline for comparison has shifted upwards, meaning an additional 7% rise would be even more pronounced than in 2021.

Inflation appears to be a given in the current economic landscape. The most effective strategy for mitigating its impact is to invest in assets that appreciate at a rate surpassing inflation to preserve purchasing power.

Chapter 2: Current Inflation Insights and Future Predictions

This video titled "CPI Shows Lowest Annual Rate Since 2021" provides insights into recent changes in the Consumer Price Index and its implications for the economy.

In this video titled "U.S. inflation drops to lowest level since early 2021," the discussion revolves around the latest trends in U.S. inflation and what they mean for consumers and businesses alike.