# Blind Chimpanzees and the Wealth of Cryptocurrencies: Insights from Raoul Pal

Written on

Chapter 1: Raoul Pal's Unique Perspective

Raoul Pal, a renowned macroeconomic expert, has a knack for identifying emerging trends in the market. His articulate storytelling and ability to convey complex concepts in an accessible manner have attracted millions of viewers online. His experiences traveling to 60 countries in his twenties profoundly influenced his worldview.

During a transformative trip to India, Pal participated in a ceremony led by Tibetan monks, which involved meditation, chanting, and traditional instruments. This experience introduced him to a lifestyle focused on simplicity and detachment from material possessions.

Tibetan monks embrace the principle of impermanence, recognizing that everything is in a constant state of flux. This philosophy fosters a sense of freedom and reduces attachment to outcomes, enabling them to navigate risks with greater ease.

Pal's inquisitiveness drives him to explore unconventional ideas, whether they stem from Tibetan culture or innovative financial concepts. This open-minded approach is vital in the realm of cryptocurrency.

As Pal suggests, maintaining an open mind and avoiding rigid affiliations can help investors tap into the vast potential of cryptocurrencies. He believes the cryptocurrency market could expand by 200 times, presenting an unprecedented opportunity in human history.

Video Description: Raoul Pal discusses the transformative nature of cryptocurrencies and how even a blind chimpanzee could succeed in investing in them, highlighting the rapid growth and adoption of digital currencies.

Chapter 2: The Growing Adoption of Crypto

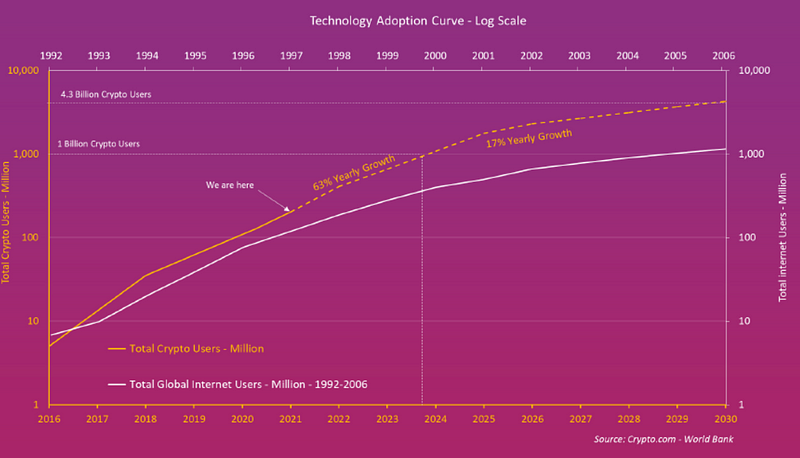

Pal's assertion that even a blind chimp could thrive in cryptocurrency investment underscores the immense growth potential in this sector. He emphasizes that the rate of cryptocurrency adoption is rising at an astonishing 113% annually, significantly surpassing the early growth rate of the internet, which stood at 63%.

With this rapid adoption, Pal anticipates that by 2030, there could be as many as 4 billion cryptocurrency users. He argues that this growth trajectory is indicative of substantial price increases across the market.

Pal points to the size of the cryptocurrency market, which recently reached $2 trillion, while global equities, bonds, and real estate are valued at approximately $200 trillion each. This disparity suggests a potential 100-fold increase in cryptocurrency valuations as traditional assets move onto the blockchain.

Chapter 3: Embracing the Investment Landscape

To navigate the evolving cryptocurrency landscape, Pal advises investors to broaden their perspectives. By doing so, they can alleviate the fear of making poor investment choices and focus on strategic bets across various cryptocurrencies.

Pal suggests a straightforward approach: invest in well-known assets like Bitcoin and Ethereum, while also exploring emerging options like Solana and Polkadot. His perspective is clear: even random selections of cryptocurrencies could yield significant returns over time.

Final Thoughts

Raoul Pal's insights highlight the significant demand driving the cryptocurrency market. While some cryptocurrencies may experience exponential growth, others could become obsolete. For the average investor, adopting a Dollar Cost Averaging strategy into Bitcoin and Ethereum over the long term is a prudent approach.

Stay informed and receive daily insights from leading experts in crypto, business, finance, and technology by joining my Substack today—completely free of charge!

Note: This article is for informational purposes only and should not be construed as financial, tax, or legal advice. Always consult a financial professional before making substantial financial decisions.